Looking ahead at the end of 2021, the S&P 500 index has nearly doubled in the past three years, with an annualized rate of return of 27%. However, Deutsche Bank’s survey of more than 750 investors around the world shows that about 20% expect the S&P 500 index to have negative returns next year, with an average increase of only 4.2%.

Can the bull market of US stocks continue, and what risks will it face? What kind of opportunities are there?

US stocks as a whole: three elements or building a structural market

1. Corporate profit growth slowed down.

According to the Morgan Stanley report, in the first three quarters of this year, the earnings per share of S&P 500 companies increased by over 67%, far higher than the average of 6% from 2001 to 2020. UBS predicts that the profit growth rate of S&P 500 companies may significantly slow down to 10% in 2022.

2. Tightening liquidity

() It is believed that the most relaxed point of global liquidity has passed. With the beginning of Taper by the Federal Reserve and the marginal tightening by the central banks of other major overseas economies, global liquidity began to enter a tightening cycle.

3. Valuation regression

According to the analysis of CITIC Securities, after the completion of taper by the Federal Reserve, the dynamic PE of US stocks will gradually return from the current high of 21.4 times to the historical average of 18 times since 2015. It is expected that the US stock market will present a structural market next year.

In the face of many challenges, we sorted out the views of investment banks and listed the US stock sector and its key words worthy of attention in 2022.

New energy: the inflection point of new energy vehicles in the United States+the installed capacity of scenery has increased greatly

On November 19th, the US House of Representatives passed the Biden administration’s $1.75 trillion stimulus bill, of which about $550 billion will be used in the new energy industry, and the tax credits in new energy vehicles, photovoltaic wind power and energy storage industries will be fully increased.

CICC believes that the US new energy vehicle market has been in a "depression" in the global market for a long time due to the previous weak policies, few high-quality vehicles and weak industrial chain. The penetration rate of new energy vehicles in the United States from 1 to 1-3Q21 was only 3.7%, which was significantly lower than that in China and Europe (13.5% and 17.3%). However, with the continuous promotion and strengthening of the Biden administration’s new energy vehicle policy and the acceleration of the electrification transformation of local car companies, the development of new energy vehicles in the United States will usher in an inflection point.

In terms of photovoltaic wind power, with the increasing momentum of energy transformation, the newly installed capacity of American scenery is expected to set a new record in 2022.

According to the survey report of Standard & Poor’s Global Market Intelligence Company, it is estimated that 44GW of utility-scale photovoltaic projects will be put into operation in the United States in 2022, nearly twice the estimated new installed capacity of 23GW in 2021. At the same time, it is estimated that the newly installed capacity of wind power in the United States will reach 27GW in 2022, significantly exceeding the highest annual record of 16GW set in 2020.

BlackRock pointed out that the world is currently transforming into a more sustainable aspect, ahead of schedule. The investment in sustainability has undergone a structural change, and related assets will highlight the advantages of return on investment in the next few years.

Energy, real estate and finance: safe-haven sectors under the strongest inflation in 40 years

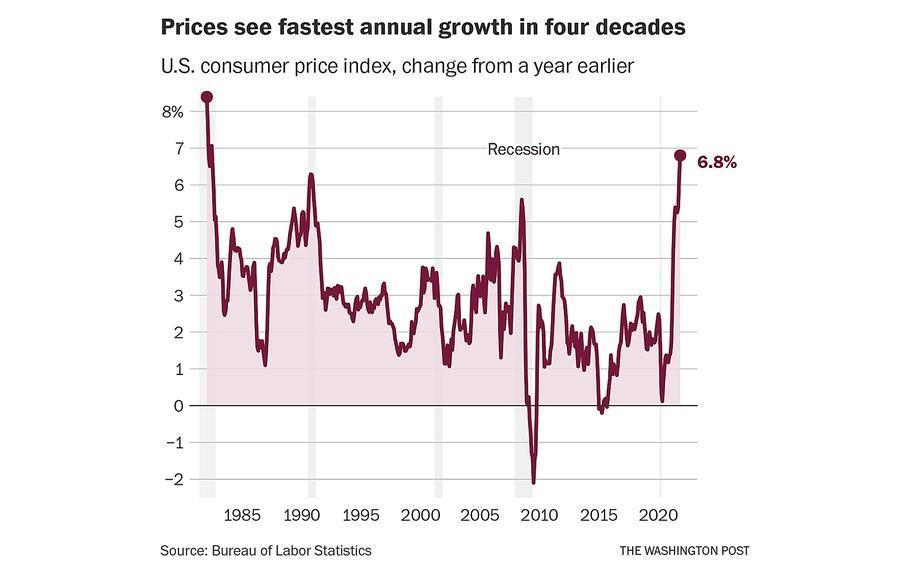

The CPI of the United States in November increased by 6.8% year-on-year, the highest since June 1982. Excluding food and energy prices, the so-called core CPI rose by 0.5% from the previous month and 4.9% from the same period of last year, the biggest increase since mid-1991.

Bank of America strategists believe that under the influence of high inflation, the current real profit rate of the S&P 500 index is negative, which indicates the downside risk of the market. Taking history as a mirror, there have been bear markets in the first four times in history when the real profit rate of the S&P 500 is negative. Investors are advised to seek safety in anti-inflation sectors such as energy, finance and real estate.

According to the analysis of CITIC Securities, under the background that the U.S. economic recovery continues in the first half of next year and inflation remains high, energy, raw materials and other sectors will benefit from the expansion of the scissors gap between PPI and CPI, and EPS (net profit per share) and gross profit margin of individual stocks are also expected to show an upward trend. In addition, after the Federal Reserve lifted the restrictions on bank stock repurchase and dividend distribution on June 30 this year, the repurchase amount of American financial companies has returned to the level of $16 billion per month before the epidemic, which will support the valuation and ROE (return on net assets) of the industry.

Internet technology: liquidity tightening risk vs structural opportunities for technological innovation

In December, the Federal Reserve will double the rate of bond purchase, and the bitmap shows that it will raise interest rates three times next year. Many analysts believe that tight monetary policy will pose a threat to the high valuation sector. The current P/E ratio of Nasdaq 100, a cluster of technology stocks, is about 30, which is 21.4 times higher than that of the broader S&P 500.

The Deutsche Bank report pointed out that inflation may be the main reason for most interest rate hike cycles in the United States. There is a "strong and consistent" negative correlation between the P/E ratio of US stocks and inflation ―― that is, under the high inflation environment, the valuation (PE) of US stocks tends to decline.

In view of the fact that the United States is under the worst inflationary pressure in 40 years, it may be comparable to the 1980s when the Federal Reserve was forced to raise interest rates due to the same inflationary pressure. During the two interest rate hike cycles in the 1980s, the P/E ratio of US stocks both fell ―― but it does not mean that the stock market fell across the board. In fact, the strong profit growth of US stock companies in these two periods made the S&P 500 index record a range increase of 8% and 23% respectively.

It can be seen that even if the Fed raises interest rates under the pressure of high inflation, it does not mean "the end of the world" for US stocks. The key is whether individual companies can offset the negative impact of interest rate hike on valuation with strong performance growth. During this period, it is difficult to cash in the growth rate of performance, but companies with high valuations may face challenges.

According to Bloomberg’s unanimous forecast, the overall expenditure scale of information technology companies in the S&P 500 stocks is expected to be 110.8 billion US dollars in 2022, with a year-on-year growth rate of 24.3%, which is the largest since the statistics in 2015. Whether it is soft technology or hard technology, capital expenditure is obviously positive.

Industrial Securities pointed out that FAANGs and other technology leaders focused on the direction of capital expenditure, including new energy vehicles, Metauniverse, digital currency, self-driving cars, AR/VR, cloud services, digital media and so on. Next year, the slowdown of US economic growth will weaken the kinetic energy of the overall profit improvement of US stocks and restrict the performance of the index. However, the structural highlights of the American economy in 2022, especially scientific and technological innovation, deserve attention.

Semiconductor: high valuation+supply and demand reversal risk accumulation

The Philadelphia Semiconductor Index (SOX Index), which includes chip manufacturers such as NVIDIA and AMD, has increased by 36% this year, with an increase of more than 50% in the previous two years and a cumulative return of 250% in three years. The current dynamic PE of SOX index is 6.3 times, but its 10-year average is only 3.6 times.

This year, the global wave of Internet of Things and car electrification, and the instability of the supply chain caused by repeated epidemics have caused an unprecedented shortage of chips in almost all industries. Although the shortage of automobile chips remains to be solved, the demand for semiconductors in other fields may have tended to weaken. According to industry data, the growth of global chip sales slowed down for the third consecutive month in October and has fallen back to the level of May this year.

Hocktan, CEO of Broadcom, a chip maker, also said in the conference call in the fourth quarter that some areas of the semiconductor market were "a bit too hot".

According to the assessment of CITIC Securities, as a typical cyclical industry, the global PC sales volume is expected to basically peak in 2021, and the data center hardware uplink cycle will peak in 2022Q2. Considering the marginal weakening of downstream demand (PC, server, smart phone, etc.) next year and the continuous release of new semiconductor production capacity, it is judged that the risk of supply and demand reversal in the industry is accumulating.

Aviation: North American aviation industry is expected to turn losses+epidemic concerns ease

According to the latest forecast given by the International Air Transport Association (IATA) in October, it is estimated that the expected loss of the whole industry in 2021 is 51.8 billion US dollars, which is 63% lower than the net loss of 137.7 billion US dollars in 2020. It is estimated that the loss will drop to 11.6 billion US dollars in 2022, and it is expected to turn losses into profits in 2023.

In terms of regions, IATA expects airlines in North America to take the lead in restoring profitability in 2022. It is estimated that airlines in this region will achieve a profit of 9.9 billion US dollars in 2022, which is the only region in the world to turn losses into profits next year.

Guoyuan International believes that the most difficult period of the global aviation industry has passed, and the passenger volume and profitability are on the track of recovery. The resilience of domestic aviation market demand is still strong, and the gradual relaxation of international routes in the future is a high probability event. It is suggested to reverse the layout of airlines, airports and aviation information targets.

Strategists in JPMorgan Chase said that although COVID-19 variants (such as Delta and Omicron) have repeatedly caused epidemics in various countries, if people’s natural immunity, vaccine-acquired immunity, significantly reduced mortality and specific drugs are gradually emerging, the epidemic will not be the primary risk next year.

關于作者